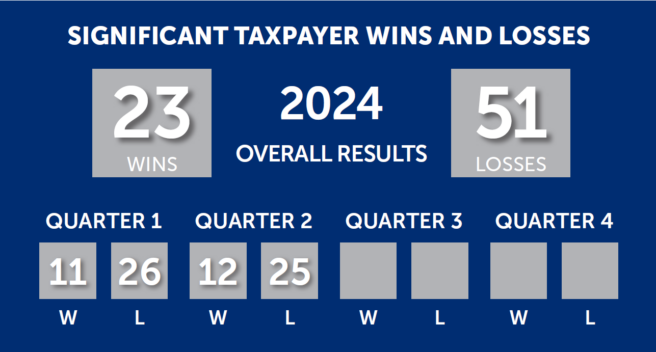

On February 26, join Eversheds Sutherland attorneys Charles Capouet and Periklis Fokaidis for a comprehensive review of the long‑standing SALT Scoreboard publication and the most significant state tax decisions from across all of 2025, with a particular focus on Q3 and Q4 developments.

In addition to recapping the year’s key case opinions, Charles and Periklis