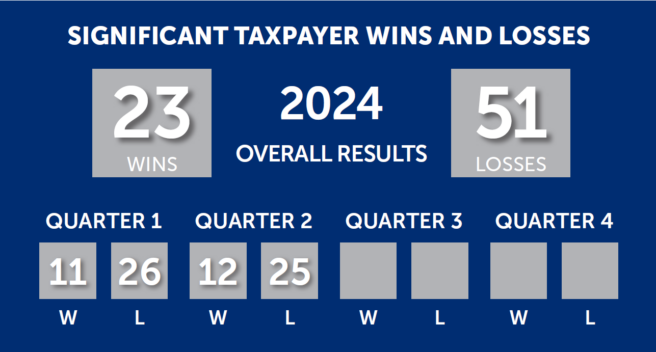

This is the third edition of the Eversheds Sutherland SALT Scoreboard for 2024. Since 2016, we have tallied the results of significant taxpayer wins and losses and analyzed those results.

View our Eversheds Sutherland SALT Scoreboard results from the third quarter of 2024 now!