The Colorado Court of Appeals held that the City of Aurora correctly levied use tax on American Multi-Cinema, Inc.’s (AMC’s) license agreements with film distributors. The court concluded that the true object of the arrangement was to obtain tangible personal property (i.e., the data files) rather than being a nontaxable, intangible right. In the past,

Noteworthy Cases

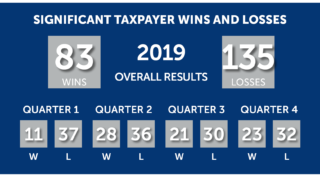

SALT Scoreboard – Fourth Quarter 2019

This is the final 2019 edition of the Eversheds Sutherland SALT Scoreboard. Since 2016, we have tallied the results of what we deem to be significant taxpayer wins and losses and analyzed those results. This edition of the SALT Scoreboard includes a discussion of the Wisconsin Court of Appeals’ decision regarding “look through” receipts sourcing,…

Maryland Digital Advertising Tax Hearing Scheduled – January 29, 2020 at 1 p.m. Eastern

Earlier this month, Maryland State Senators Miller and Ferguson introduced Senate Bill 2, which would tax Maryland digital advertising service gross revenues at up to a 10% rate. Earlier today, the Department of Legislative Services issued the Fiscal and Policy Note for the proposal, which estimates up to $250 million of revenue in the…

One For All – Michigan Court of Appeals Holds that Financial Institution’s Unitary Business Group Must be Treated as a Single Taxpayer

The Michigan Court of Appeals reversed the Court of Claims and held that an assessment of additional franchise tax on a bank was invalid because the Department of Revenue had improperly calculated the tax base of the bank’s unitary business group (“UBG”). The Michigan Business Tax Act provides that, for a financial institution, the “tax…

SALT Scoreboard – Third Quarter 2019

This is the third edition of the Eversheds Sutherland SALT Scoreboard for 2019. Since 2016, we have tallied the results of what we deem to be significant taxpayer wins and losses and analyzed those results. This edition of the SALT Scoreboard includes a discussion of the Illinois Appellate Court’s recent decision in Labell v. City…

Utah Tax Commission Doesn’t Want a Piece of Your Video Streaming

On April 10, 2019, the Utah Tax Commission issued a private letter ruling to a video streaming provider (“Taxpayer”) finding that the Taxpayer’s sales of subscriptions entitling subscribers to enhanced features on the Taxpayer’s streaming platform, are not subject to sales and use tax. On its internet-based platform, the Taxpayer provides a video streaming service…

SALT Scoreboard – Second Quarter 2019

This is the second quarter edition of the Eversheds Sutherland SALT Scoreboard for 2019. Since 2016, we have tallied the results of what we deem to be significant taxpayer wins and losses and analyzed those results. This edition of the SALT Scoreboard includes a discussion of the United States Supreme Court’s recent decisions in Kaestner…

South Carolina Administrative Law Court Holds it May Not Enforce Summons for Delivery Records Issued to North Carolina Freight Carrier

The South Carolina Administrative Law Court (ALC) held that it could not enforce a Department of Revenue (Department) summons for delivery records issued to a North Carolina freight carrier that regularly transported out-of-state furniture into South Carolina. The Department’s summons requested records of all deliveries the company made into South Carolina, including each purchaser’s name,…

New Jersey Tax Court Allows Unreasonable Exception to Royalty Addback

The New Jersey Tax Court held that a parent corporation was not required to add back to its corporation business tax base any amount of royalty payments it made to a subsidiary. The parent company and subsidiary company each filed a New Jersey CBT return. The parent deducted the royalty payment, and the subsidiary included…

SALT Scoreboard – First Quarter 2019

This is the first edition of the Eversheds Sutherland SALT Scoreboard for 2019. Since 2016, we have tallied the results of what we deem to be significant taxpayer wins and losses and analyzed those results. This edition of the SALT Scoreboard includes insights regarding Virginia’s costs of performance sourcing, New Jersey’s addbacks of intercompany expenses,…